Ever wondered where your Council tax goes?

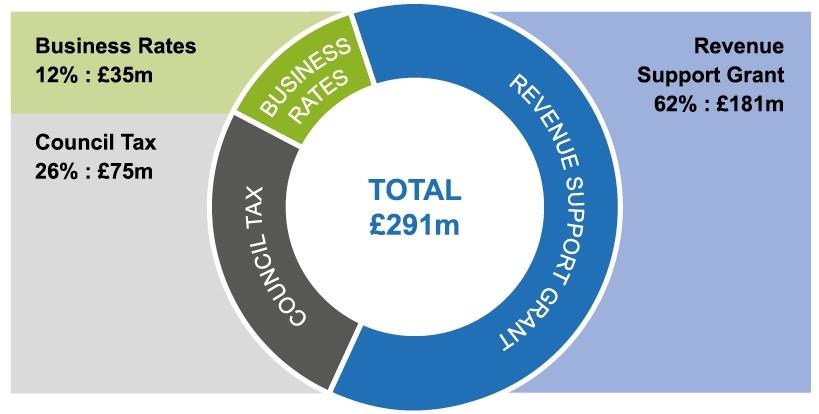

Many people think that Council tax pays for everything that a local authority delivers, however, the money collected from residents annually only accounts for 26% of total Council spending.

The majority of funding (62%) comes in the form of a ‘Revenue Support Grant’ from Welsh Government, while the remaining 12% comes from business rates which is a property tax that businesses pay to help fund local services. You can find out more about how the Council is funded on our website.

The majority of funding (62%) comes in the form of a ‘Revenue Support Grant’ from Welsh Government, while the remaining 12% comes from business rates which is a property tax that businesses pay to help fund local services. You can find out more about how the Council is funded on our website.

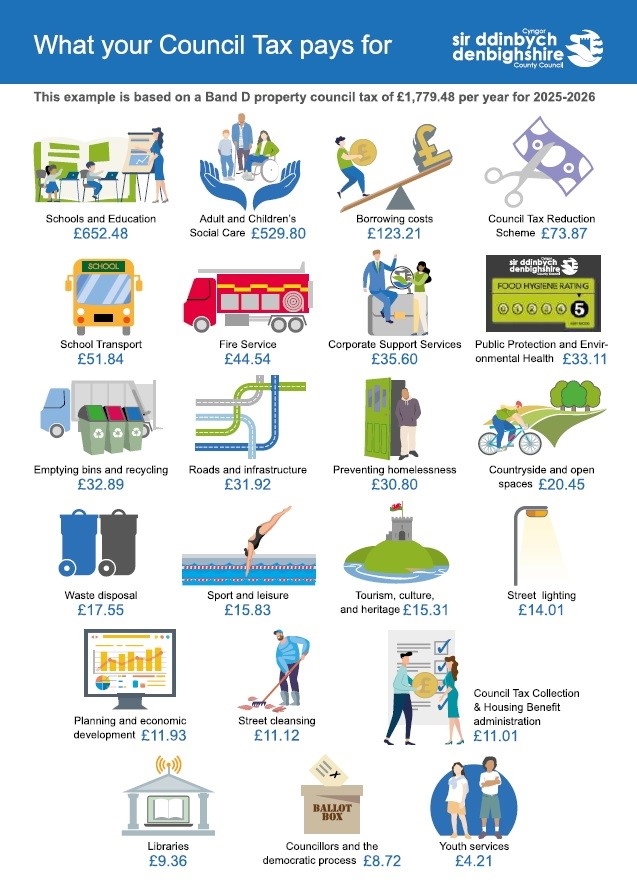

So where does your Council tax actually go? We’ve produced an infographic based on a Band D property council tax bill to help give a clear explanation of how council tax payments are used to fund the range of services for residents in the county. While this infographic gives a picture of how the money is shared between different services, understanding what residents gets for that money is really important.

As you can see, the majority of council tax spending goes towards protecting the most vulnerable in our society, with 66% spent on schools and education and adult and children’s social care.

With Education accounting for 36.7%, it means that Denbighshire can educate approximately 16,500 pupils in 44 primary schools, 2 all-through schools, 2 special schools, 6 secondary schools and 1 pupil referral unit across the county, with approximately 780 teachers delivering this education

With Education accounting for 36.7%, it means that Denbighshire can educate approximately 16,500 pupils in 44 primary schools, 2 all-through schools, 2 special schools, 6 secondary schools and 1 pupil referral unit across the county, with approximately 780 teachers delivering this education

Still in the field of education, school transport accounts for 2.9% for which the Council transports approximately 2,871 learners safely to schools throughout the county. In total, there are 650 school bus and taxi trips every school day.

Meanwhile, adult and children’s social care accounts for 29.8% of Council tax spending. For this, in 2024-2025, an average of 668 members of staff had over 25,000 contacts with the most vulnerable children and adults and provided a package of care and support where necessary giving these residents the opportunity to exercise choice, voice and control over their lives.

Meanwhile, adult and children’s social care accounts for 29.8% of Council tax spending. For this, in 2024-2025, an average of 668 members of staff had over 25,000 contacts with the most vulnerable children and adults and provided a package of care and support where necessary giving these residents the opportunity to exercise choice, voice and control over their lives.

In other service areas, 1.9% goes towards public protection and environmental health and the Council’s teams inspects approximately 720 restaurants, cafes and take aways every year to ensure they’re operating safely for the residents of Denbighshire.

Emptying bins and recycling accounts for 1.8% of your council tax bill, which equates to £32.89 per year (based on a Band D property). That involves collecting around 73,000 containers from over 47,000 households every week across the county.

Emptying bins and recycling accounts for 1.8% of your council tax bill, which equates to £32.89 per year (based on a Band D property). That involves collecting around 73,000 containers from over 47,000 households every week across the county.

For 1.8% of council tax, we maintain 1,419km of carriageways (excluding trunk roads), 601 highway bridges and culverts, 302 retaining walls and 26,000 gullies. And for 0.8%, we maintain 11,763 street lights and 1,547 illuminated signs and bollards throughout the county.

Other services residents may not be aware that are delivered by the Council are the Countryside and Heritage Services. With 1.1% of council tax going to the countryside service, the teams manage over 80 sites and more than 1,200 hectares of public green for both recreation and conservation. These range from the Country Parks of Loggerheads and Moel Famau, the county tree nursery at St. Asaph, Brickfield Pond in Rhyl, Prestatyn Dyserth Way, Llantysilio Green in the Dee Valley and numerous smaller amenity community spaces across the county.

Other services residents may not be aware that are delivered by the Council are the Countryside and Heritage Services. With 1.1% of council tax going to the countryside service, the teams manage over 80 sites and more than 1,200 hectares of public green for both recreation and conservation. These range from the Country Parks of Loggerheads and Moel Famau, the county tree nursery at St. Asaph, Brickfield Pond in Rhyl, Prestatyn Dyserth Way, Llantysilio Green in the Dee Valley and numerous smaller amenity community spaces across the county.

While the heritage service accounts for 0.9% of Council tax spending and for this, the service preserves and promotes the county’s unique history, caring for important historic sites including Ruthin Gaol, Plas Newydd, Nantclwyd Y Dre, Rhyl Museum (based in the library) and a large collection store. This work ensures Denbighshire’s rich history remains accessible for education, wellbeing, and enjoyment.

Planning and economic development accounts for 0.7% of Council tax spending and for that the Local Planning Authority processes around 1,000 planning applications each year alongside 10-20 appeals and 50-100 pre-application enquiries. We also respond to over 500 planning compliance cases.

Libraries account for 0.5% of Council tax spending and in 24-25, Libraries delivered 514 Bookstart sessions to nearly 6,500 children for this money. It also lent 2,869 audiobooks to 1,028 library members on Borrowbox (part of the Digital Offer) and printed over 56,000 pages on public access printers.

Libraries account for 0.5% of Council tax spending and in 24-25, Libraries delivered 514 Bookstart sessions to nearly 6,500 children for this money. It also lent 2,869 audiobooks to 1,028 library members on Borrowbox (part of the Digital Offer) and printed over 56,000 pages on public access printers.

Not all Council tax collected pays for council services, 2.5% goes towards the Fire service to contribute to the funding of fire protection and prevention across the county.

Councillor Delyth Jones, Lead Member for Finance at Denbighshire County Council said, “I am pleased to see the production and release of this infographic information. It will, I hope, provide residents with the context they need in order to understand how their council tax payments are used to support the breadth of services delivered by the Council.

“In what is a continuing financially challenging climate, I think it’s important to be open and clear about the costs and the pressures. It’s also important to emphasise that many of the aspects of expenditure are, quite rightly, aimed towards the legal requirement to provide Adult Social Care, Children’s Services, and Education etc. These are the areas that support the most vulnerable in our society.”